How can we Help?

As a member of Fond du Lac Credit Union, you can talk with one of our financial counselors at no cost to you. Here are a few ways our financial counselors could help.

Budgeting

Discuss your overall household budget, track expenses and income, and explore how to better utilize your funds.

Saving

Discuss long and short-term financial goals and establish savings plans to buy a home, purchase a vehicle, or feel more secure with your savings.

Credit Counseling

Understand your current credit score, learn what can impact your score (positively and negatively), and work together to increase your credit score or maintain a high rating.

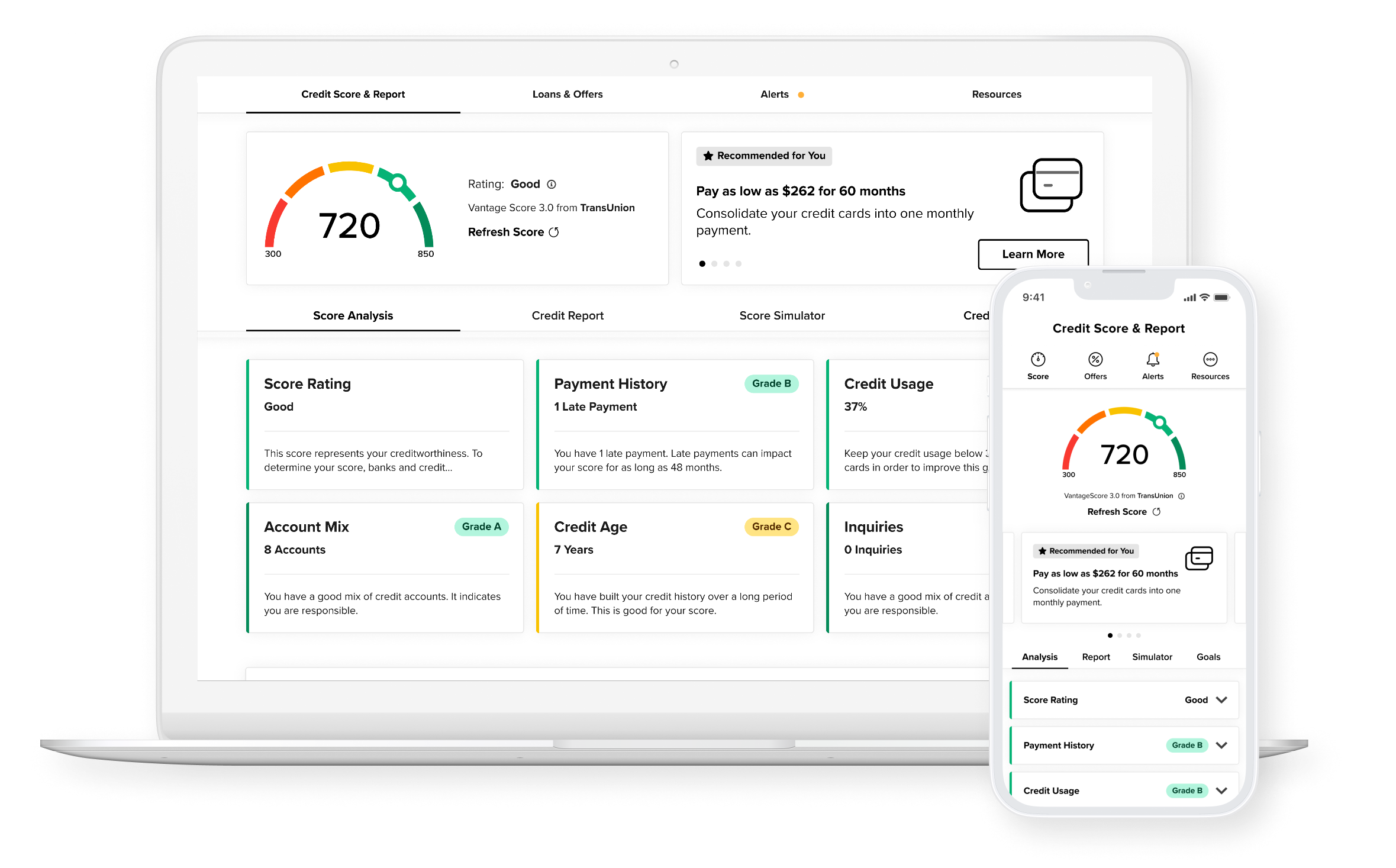

Your Free Credit Score, and more.

With one powerful tool, access your credit score, full credit report, credit monitoring, financial tips, and education.

View your credit score and report for free at any time, without affecting your credit. Log in to your Fond du Lac Credit Union Online/Mobile Banking and tap Show my Score on your Dashboard to register.

Education Resources

Save On Holiday Shopping

If you’re worried about making it through the holiday shopping season in the midst of record inflation, you’re not alone. A recent survey shows that 59% of American shoppers are stressed about buying holiday gifts this season due to higher prices. However,...

Planning For Retirement

It’s never too early – or too late – to start planning for your retirement. However, like all long-term savings goals, retirement should ideally be planned for as much in advance as possible. That’s because the more time you allow for your savings to grow, the bigger...

What You Should Know About Your Credit Score

Your credit score is a three-digit number that is used to determine whether you’ll get approved for financial products like credit cards and loans. Credit scores typically range from 300 to 850, but they can vary due to different scoring models. You may...