How can we Help?

As a member of Fond du Lac Credit Union, you can talk with one of our financial counselors at no cost to you. Here are a few ways our financial counselors could help.

Budgeting

Discuss your overall household budget, track expenses and income, and explore how to better utilize your funds.

Saving

Discuss long and short-term financial goals and establish savings plans to buy a home, purchase a vehicle, or feel more secure with your savings.

Credit Counseling

Understand your current credit score, learn what can impact your score (positively and negatively), and work together to increase your credit score or maintain a high rating.

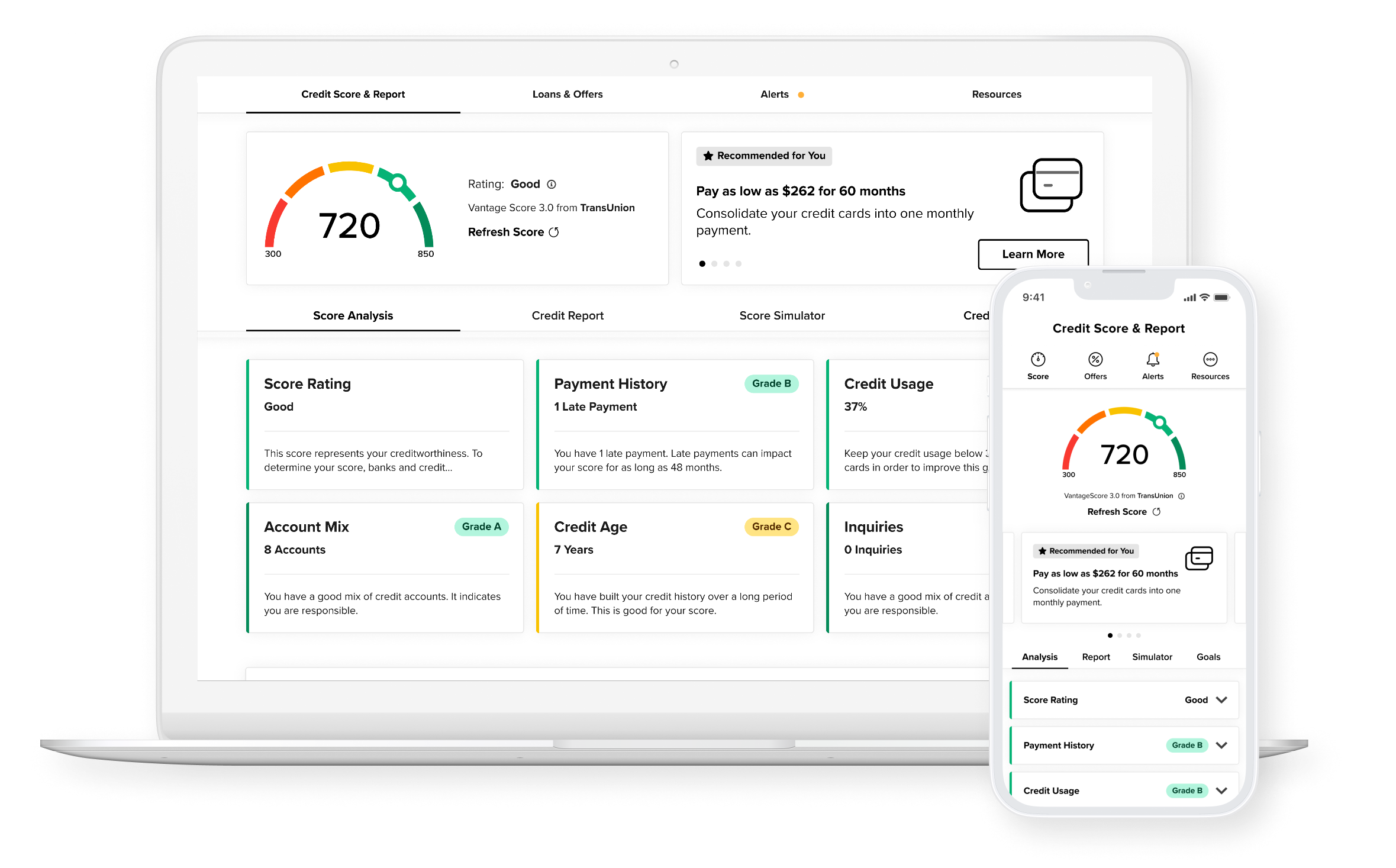

Your Free Credit Score, and more.

With one powerful tool, access your credit score, full credit report, credit monitoring, financial tips, and education.

View your credit score and report for free at any time, without affecting your credit. Log in to your Fond du Lac Credit Union Online/Mobile Banking and tap Show my Score on your Dashboard to register.

Education Resources

Virtual Shopping Smarts – Financial Literacy for Kids

Did you know that 73% of millennials do all their shopping on their smartphones? It’s not surprising, really. The world of commerce is constantly becoming more digitized as retailers focus on improving their online presence to cater to cyberspace shoppers. Online...

Don’t Get Caught in an Auto Warranty Scam

If you drive a car and own a phone, you’ve likely been targeted by this scam once or twice – or maybe even a thousand times. It’s the scam that tips the scale on robocalls and takes them from “mild inconvenience” to “royal pain in the neck”. But auto warranty scams...

Curbing Impulse Purchases – Financial Literacy for Kids

It’s no secret that impulse buys can wreak havoc on even the most carefully constructed budget, but learning to curb those impulses is an ongoing struggle. Here’s a strategy you can use to teach your kids that turning down those small impulses can mean saving big and...