How can we Help?

As a member of Fond du Lac Credit Union, you can talk with one of our financial counselors at no cost to you. Here are a few ways our financial counselors could help.

Budgeting

Discuss your overall household budget, track expenses and income, and explore how to better utilize your funds.

Saving

Discuss long and short-term financial goals and establish savings plans to buy a home, purchase a vehicle, or feel more secure with your savings.

Credit Counseling

Understand your current credit score, learn what can impact your score (positively and negatively), and work together to increase your credit score or maintain a high rating.

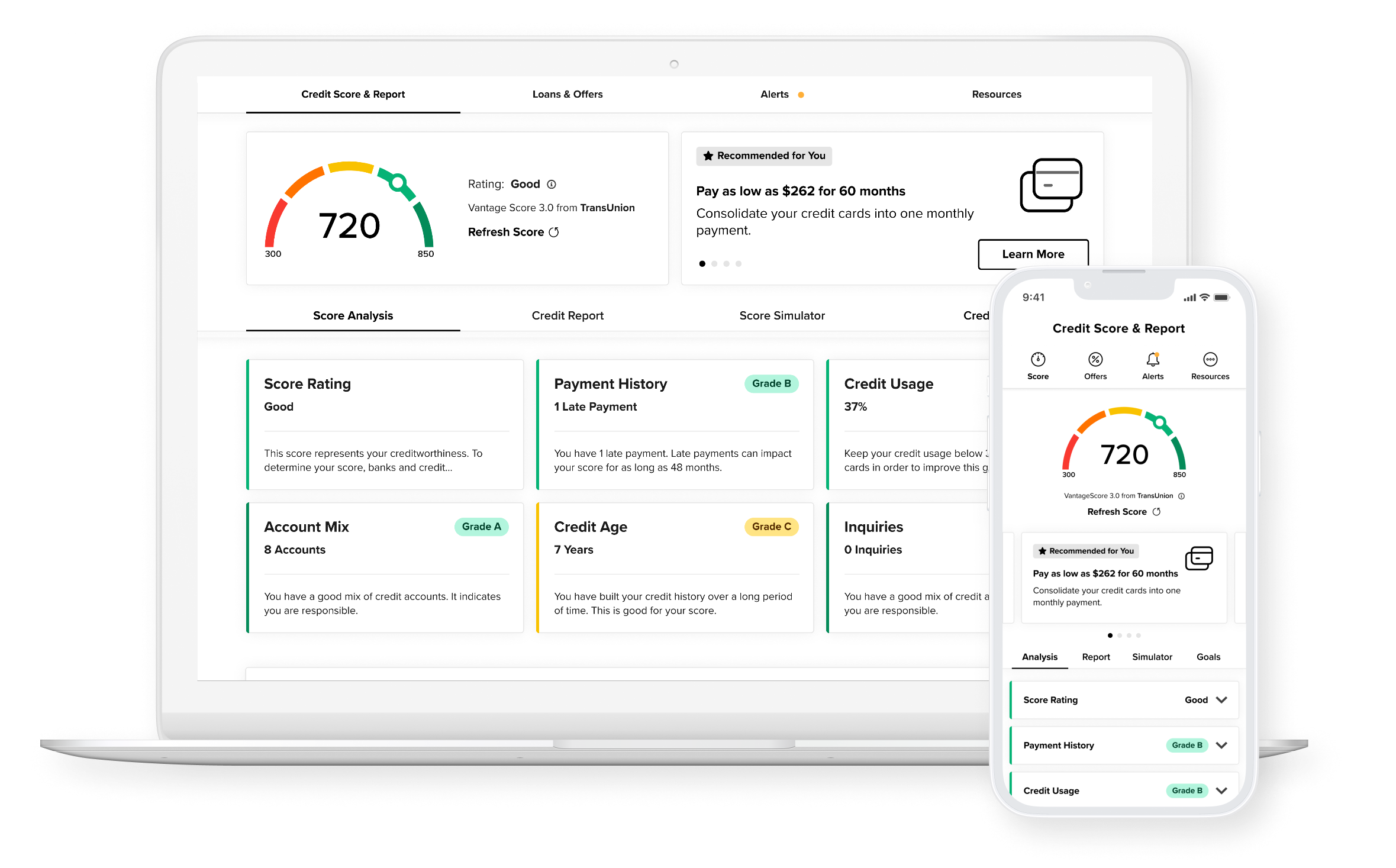

Your Free Credit Score, and more.

With one powerful tool, access your credit score, full credit report, credit monitoring, financial tips, and education.

View your credit score and report for free at any time, without affecting your credit. Log in to your Fond du Lac Credit Union Online/Mobile Banking and tap Show my Score on your Dashboard to register.

Education Resources

Beware of Digital Kidnapping

Most parents warn their kids against taking candy or accepting a ride from a stranger, but there’s a digital equivalent to conventional kidnapping that is unknown to many people. Digital kidnapping happens when a crook takes control of a target’s social media profiles...

Financial Lessons You Can Learn from Fantasy Football

As summer winds down with autumn creeping closer, it’s time to start thinking fantasy football! Drafting the best team and guiding them toward the championship takes knowledge, dedication, skill and real talent. Do you have what it takes to be a fantasy football...

Should You Keep Cash at Home?

We're seeing posts on social media about keeping cash at home during rapid inflation. Is this a good practice? Keeping large amounts of cash in envelopes, kitchen drawers, or stuffed under the mattress is not recommended during times of high inflation – or any...