Fixed Rate Home Equity Loan

Fond du Lac Credit Union’s home equity loan is a fixed rate loan that is determined by the appraised value of your home and the balance you owe on your existing mortgage. The entire loan amount is advanced to you when your home equity loan is approved.

The rate and payment will remain the same during the repayment period of the loan. The payment amount and number of payments depend on the repayment terms of your loan. We can offer a range of repayment terms.

And if you want to pay the home equity loan off early, go right ahead! Unlike some other financial institutions, you won’t be charged a prepayment penalty at Fond du Lac Credit Union!

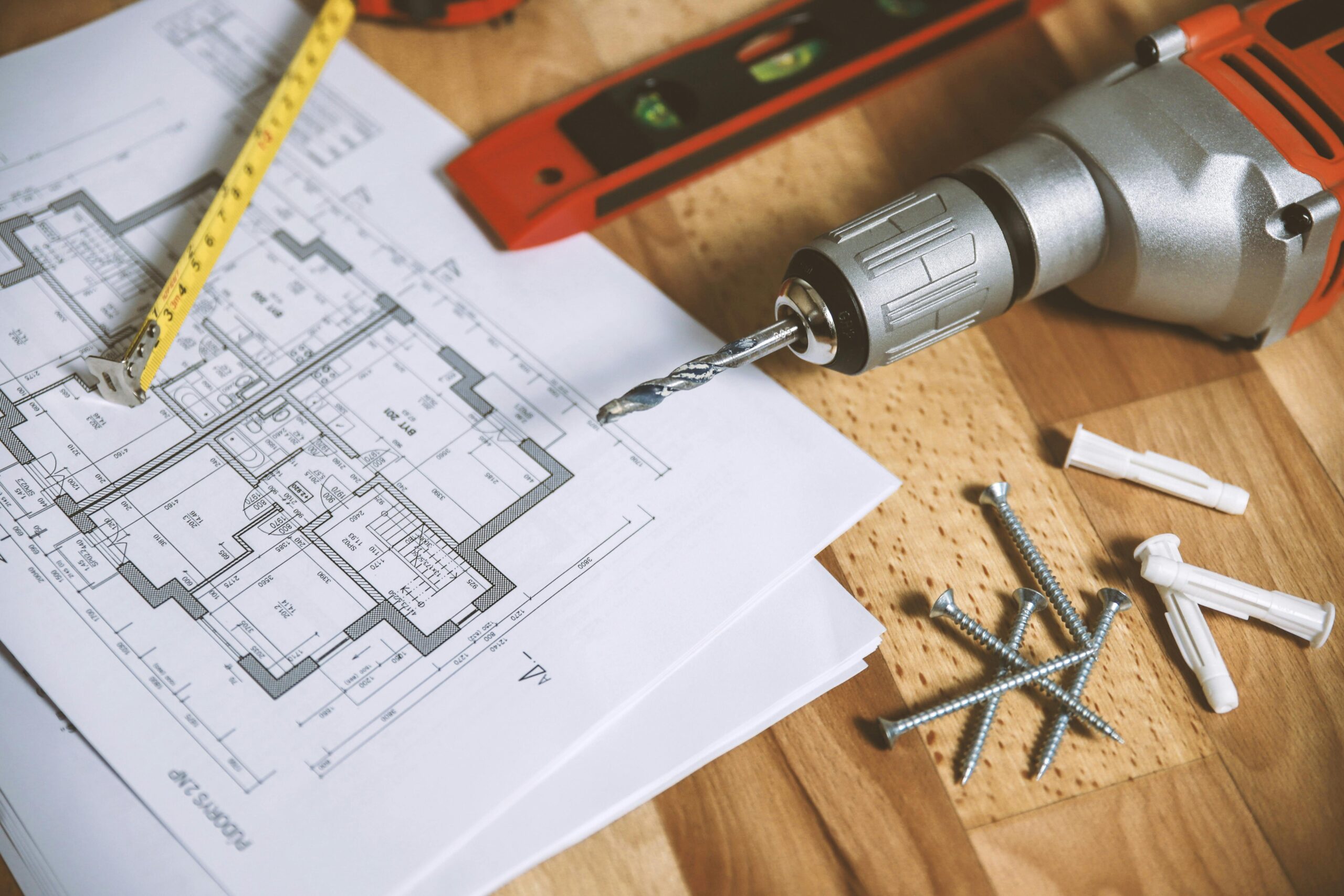

A home equity loan can be used for many purposes, but one of the best reasons is a home improvement project that will increase the value of your home.

Here are a few suggestions:

- New windows

- New roof

- Adding a porch or deck

- Additional bathrooms

- Increasing living space

- Updating a kitchen

As long as you have the equity in your home in its current state, we can look into issuing a home equity loan.

How to Apply for a Home Equity Loan

To apply for a home equity loan and see if you qualify for our best home equity loan rates, contact a Fond du Lac Credit Union Lending Specialist. We prefer appointments but will try to accommodate walk-ins.

Call us to make an appointment: