manage your finances whenever & wherever

While we love to see our members in person, we also understand that stopping at the office isn’t always convenient. Mobile & Online banking allows you to conduct much of your financial business with our mobile app, or on a computer from the comfort of your home or office.

With Fond du Lac Credit Union’s free mobile & online banking, you can:

- 24/7 Account Access – see current balance, recent activity, and pending transactions

- Remote Check Deposit – deposit checks by taking a picture of them!

- Pay your bills with Bill Pay

- Transfer funds from one Fond du Lac Credit Union account to another

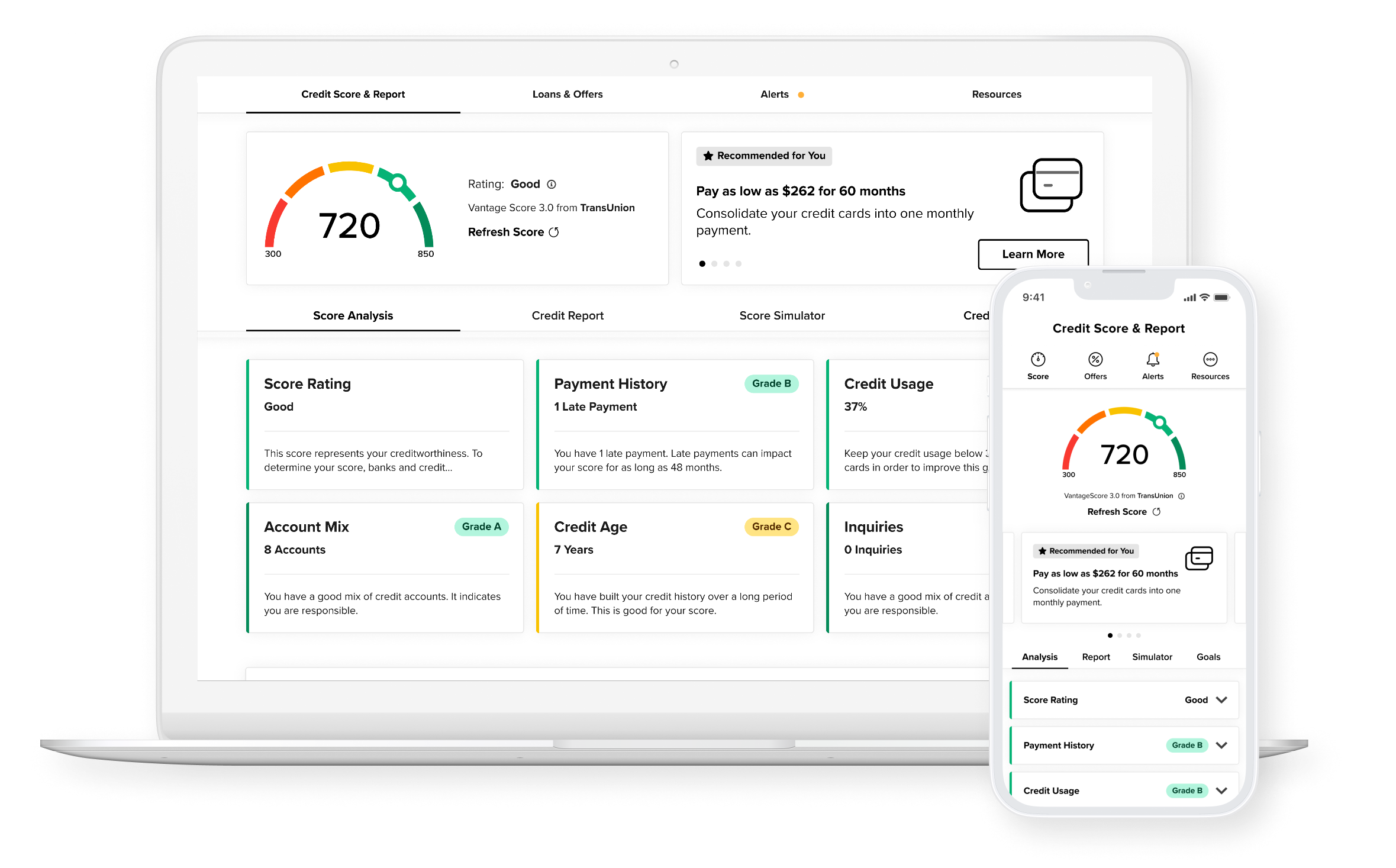

- Access to Savvy Money – view your credit score and report for free

- Apply for a loan

- View e-Statements

- Update your contact information

- View and pay your FDLCU Credit Card

- Set-up alerts

- And more!

Due to our recent core technology platform upgrade, all new and existing users of online and mobile banking will need to enroll the first time you visit.

We have put together an instruction guide to walk you through the online/mobile banking enrollment process:

your smartphone just got smarter. DOWNLOAD THE FDLCU MOBILE BANKING APP!

Your Free Credit Score, and more.

With one powerful tool, access your credit score, full credit report, credit monitoring, financial tips, and education.

View your credit score and report for free at any time, without affecting your credit. Log in to your Fond du Lac Credit Union Online/Mobile Banking and tap Show my Score on your Dashboard to register.